Basic Factors of Eligibility 510-03-35

ACA Medicaid Household 510-03-35-05

(New 7/1/2014 ML #3404)

View Archives

(N.D.A.C. Section 75-02-02.1-08)

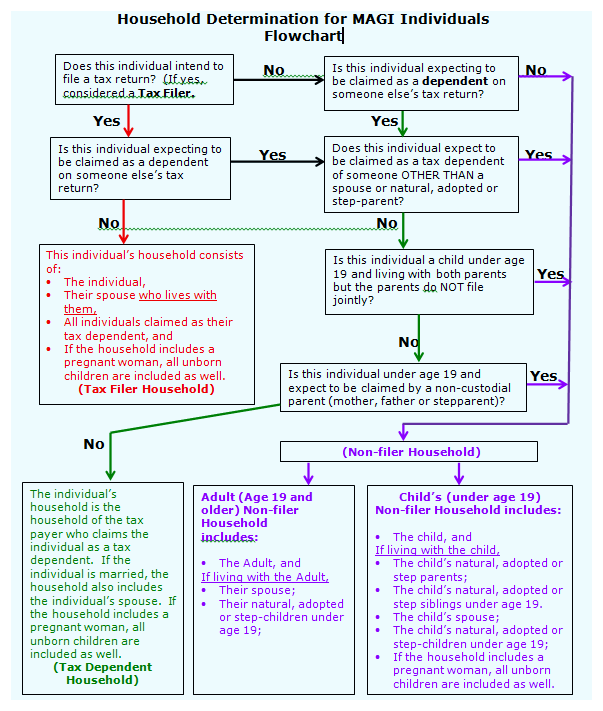

Each eligible individual must have their ACA Medicaid Household determined separately based on whether the individual is a tax filer, a tax dependent, or an adult or child non-filer as well as the individual’s relationship to those with whom the individual resides.

NOTE: Under ACA-based Methodologies, individuals may no longer be opted out of a household. However, they can choose to not receive coverage.

- Tax Filer Unit

If the person is a tax filer, that person’s Medicaid household includes:

- The individual,

- The spouse who lives with them, (regardless if they file jointly or separately),

- Everyone the tax filer claims as a tax dependent, and

- If any of these individuals are pregnant, include the number of unborn children.

Note: If the tax filer is also claimed as a tax dependent, follow the tax dependent rules.

- Tax Dependent Unit

If a person is a tax dependent, that person’s Medicaid household includes:

- The individual,

- The spouse who lives with them, (regardless if they file jointly or separately)

- Everyone in the tax filers household, UNLESS the tax dependent meets one of the following exceptions:

- The individual is claimed as a dependent by someone other than a parent, adoptive parent, or step-parent, (example by a grandparent or older adult sibling) or

- The individual is under age 19 and claimed as a dependent by an absent parent (example, child lives with Mom but absent Dad is claiming as a tax dependent), or

- The individual is under age 19 and lives with both parents but the parents do not expect to file jointly (example—parents live together but are not married).

- If any of these individuals are pregnant, include the number of unborn children.

If the tax dependent meets any of the above exceptions in 2.c., we must follow the non-filer rules in determining household size.

- Non-Filer Unit

If a person is a non-filer, that person’s Medicaid household is determined based on whether or not the non-filer is an Adult (Age 19 and older) or a Child (Under age 19).

- Non-filer Adult Household (age 19 or older) includes:

- The non-filer adult, and

- Their spouse who lives with them, and

- Their natural, adopted or step-children under age 19

- If any of these individuals are pregnant, include the number of unborn children.

- Non-filer Child Household (under age 19) includes:

- The non-filer child,

- The child’s natural, adopted or stepparents who lives with them,

- The child’s natural, adopted or step siblings under age 19 who lives with them,

- The child’s spouse,

- The child’s natural, adopted or step children under age 19 who lives with them.

- If any of these individuals are pregnant, include the number of unborn children.

Married couples, who file jointly, must be included in each other’s Medicaid households for budgeting purposes, even if not residing together.

Married couples, where one spouse is incarcerated, the incarcerated spouse must be included in other’s Medicaid households for budgeting purposes, IF-the spouses file their taxes jointly.

Note: The spouse who is incarcerated is not eligible for ACA Medicaid.

When an unmarried couple with children are not able to indicate their intent to file taxes, the parent with the highest income will be considered as claiming the child(ren).

The following flowchart and examples will assist in determining the ACA Medicaid Household for each individual:

Examples:

Note: (In all of the following examples in this section, step, half, adoptive and natural parents, siblings and children are all treated the same.)

- John is a single individual who is applying on his own. He does not plan to file income taxes.

- John is a non-filer and his household size is 1.

- Joe is a single individual who is applying on his own. He plans to file income taxes.

- Joe is a tax-filer and his household size is 1.

- a. Tony is a single individual who is applying on his own. He plans to file income taxes and is claiming his 12 year old son, Jacob who resides with his mother, Claudia.

- Tony is a tax-filer and since he is claiming his son, his household size is 2.

b. Since Jacob resides with his mother, Claudia applies for herself and her son, Jacob. Claudia files taxes, but does not claim Jacob as his father does.

- Jacob is considered a non-filer as he meets one of the exceptions in #2.c., Tax Dependent Unit rules, above. Therefore, his household size is 2.

- Claudia is considered a tax-filer and since Tony claims Jacob, her household size is 1.

- Paul and Pam are married, live together, have no children and Pam is not pregnant. Paul plans to file taxes jointly with Pam.

- Paul and Pam are tax filers and each has a household size of 2.

- Paul and Pam are married and live together with their son Peter. Paul and Pam are filing jointly and claiming Peter as a tax dependent.

- Paul and Pam are tax filers and each has a household size of 3.

- Peter is a tax dependent and his household size of 3.

- Paul and Pam are married and live together with the minor son, Peter. Paul and Pam plan to file taxes separately. Paul expects to claim their son, Peter, as his tax dependent.

- Paul is a tax filer and his household size of 3 as he is claiming his son.

- Pam is a tax filer and her household size of 2, as she is not claiming her son.

- Peter is a tax dependent but his parents are filing their taxes separately. Therefore, his household size is 2.

- Paul and Pam are married and live together with their son Peter and Pam’s mother. They plan to file taxes together and claim their son and Pam’s mother as tax dependents.

- Paul and Pam are tax filers and each has a household size of 4.

- Peter is a tax dependent and his household size is 4.

- Pam’s mother is a non-filer and her household size is 1.

- John and Julie are married. They have 2 children in common, Derik age 2 and Shawn age 10. Julie has a child from a previous relationship, Brynn, age 16. Mom and Step Dad file jointly and claim all the children on their taxes.

- John and Julie are tax filers and each has a household size of 5.

- Brynn, Shawn and Derik are tax dependents and each has a household size of 5.

- Marty lives with his grandmother, who is widowed, and she expects to claim him as a tax dependent (someone other than a parent is claiming Marty).

- Marty is a non-filer and his household size is 1.

- Grandmother is a tax filer and is claiming Marty. Grandmother’s household size is 2.

- Marcy lives with both of her biological parents, Mary and Mark, who are married but expect to file separately. Marcy expects to be claimed as a tax dependent by Mary.

- Marcy is considered a non-filer as she meets one of the exceptions in #2.c., Tax Dependent Unit rules, above. Her household size is 2.

- Mary is a tax filer and is claiming her daughter and her household size is 3.

- Mark is a tax filer and is not claiming his child. His household size is 2.

- Matt lives with his mother, Mary. Matt expects to be claimed as a tax dependent by his father, Mark who lives separately.

- Matt is considered a non-filer as he meets one of the exceptions in #2.c., Tax Dependent Unit rules, above. Therefore, his household size is 2.

- Mary is a tax filer and not claiming her son. Her household size is 1.

- Carol and Bill reside together with their 2 children, Kyle and Sarah, and Carol’s nephew, Travis. Carol and Bill file their taxes jointly and claim their two children and Carol’s nephew. Kyle, Sarah and Travis are under age 18 and not required to file income taxes.

- Carol is considered a tax-filer and claims her two children and nephew. Her household size is 5.

- Bill is considered a tax-filer and claims his two children and Carol’s nephew. His household size is 5.

- Kyle is considered a tax dependent and his household is that of the tax filer (his parents). Therefore, his household size is 5.

- Sarah is considered a tax dependent and her household is that of the tax filer (her parents). Therefore, her household size is.

- Travis is considered a non-filer child. His household size is 1.

- John lives with his girlfriend, Susan and Susan’s daughter, Mariah, age 3, who is not John’s biological, adopted, or step-daughter. He does not plan to file taxes. Susan will file taxes and claim her daughter only.

- John is a non-filer and his household size is 1.

- Susan is a tax-filer and her household size is 2.

- Mariah is a tax dependent and her household is 2.

- Katie and Alex are married and file taxes separately. They have two children, Allan and Hannah, both under age 16. Alex claims them both on his taxes.

- Katie is a tax filer and her household size is 2.

- Alex is a tax filer and his household size is 4.

- Allan is a non-filer and his household size is 4.

- Hannah is a non-filer and her household size is 4.

- Jack and Diane are married and file taxes together. They have two children of their own, Quinn age 7 and Lucy age 9. They also have a Foster Child, Stephanie, age 14. They claim their children as well as the Foster Child on their taxes.

- Jack and Diane are tax filers and each has a household size of 5.

- Quinn and Lucy are tax dependents and each has a household size of 5.

- Stephanie is a non-filer and her household size is 1.

- a. Tom and Francine are married and have 2 children, Garrett age 15 and Sonya age 19, who is living in a dorm attending college in another city. They file taxes jointly and claim both of the children on their taxes.

- Tom and Sonya are tax filers and each has a household size of 4.

- Garret and Francine are tax dependents and have a household size of 4.

- Tom and Francine are married and have 2 children, Garrett age 15 and Sonya age 19, who is living in a dorm attending college in another city. Sonya also works and will be required to file taxes on her own. However, her parents will be filing jointly and claiming both of the children on their taxes.

- Tom and Francine are tax filers and each has a household size of 4.

- Garret is a tax dependent and has a household size of 4.

- Sonya is a tax dependent and has a household size of 4.

Note: Since Sonya is required to file taxes, her income is counted in all the households in which she is included.

- Sharon is disabled and in receipt of SSI. She has 1 child, Ben, who is age 18. Sharon does not file taxes. Her son Ben is employed and earns sufficient income to require him to file taxes.

- Sharon is a non-filer and her household size is 2; herself and her son.

- Ben is a tax filer. His household size is 1.

Note: If Ben claimed his mother, his household size would be 2.

- Case consists of Sandy, her boyfriend Carl, and Sandy’s daughter Meghan, age 6 (who is not Carl’s daughter). Carl is employed and files taxes. He is claiming Sandy and her daughter.

- Carl is a tax filer and his household size is 3.

- Sandy is a non-filer and her household size is 2.

- Meghan is a non-filer and her household size is 2.